The devil wears Versace now

Prada Group is taking an L to build the next Italian fashion conglomerate, plus a peek into the creator economy

April 11, 2025 | London, UK

Hi there, and welcome back to The Brandsider: a newsletter about the business of brand. Subscribe for insider takes on how great companies use brand as a business lever - from breaking down major headlines to deep dives on the ones getting it right.

My obsession with the creator economy continues (thanks again, Danielle!!)

Partly because I went semi-viral on TikTok this week - 150K views! 7,000 likes! on a single video!

And partly because I had a string of conversations that reminded me just how underestimated the creator economy still is.

A lot of the confusion comes from people still equating the creator economy with influencer marketing. But they are different beasts.

Influencer marketing is about brands borrowing attention: paying people to promote something.

The creator economy goes far beyond that: it’s individuals building audiences, IP, and brand equity around their presence online. And these creators are fundamentally shifting how we consume - both content and product.

Yes, some make money through ads, sponsorships or classic merch shops.

But many more are graduating into building truly brand-led businesses: selling physical products, subscriptions, software etc.

And let me be clear: this is far from a niche. In February, Adobe conducted a 1,000 person survey on creator-led brands and the results shocked even me:

56% of consumers purchase from creator-led brands, with Gen Z (66%) and millennials (61%) leading the trend.

Gen Z spends $104 monthly on creator-led brands.

13% of shoppers now trust creator-led brands more than traditional ones.

So while I’m fascinated by the downstream businesses these creators are building (Feastables, Kortex, Fenty)…

I’m equally intrigued by the upstream infrastructure being built to support them.

Think Stan, Passionfroot, Kajabi, Beehiiv, Karat - all quietly enabling a massive shift in how people monetize expertise, audience, and trust.

All in all, this is a massive opportunity. Goldman Sachs estimated the creator economy could hit $500B by 2027 - and that was back in 2023. For context, that’s about the size of the global beauty industry.

To me, it feels like the creator economy today is where social media was in the early 2010s: no longer new, but not yet fully realized. It’s a coming of age, and people are just starting to pay attention.

And I cannot wait to see where it takes us. More on this soon.

Tamara

Brands in this week’s newsletter: Prada, Versace, Apple TV, Lumon, Hooters, Jaguar Land Rover, Weight Watchers, Coffee Mate, Duke, The Royal Ballet and Opera

P.S. If you like the Brandsider, the best way to show support is by sharing this with 2 people who might find it interesting.

It would help me immensely and also put the biggest smile on my face 🫶🏻

✨ Where Business Meets Brand

Deeper analysis, as covered on IG / TikTok / YouTube Shorts

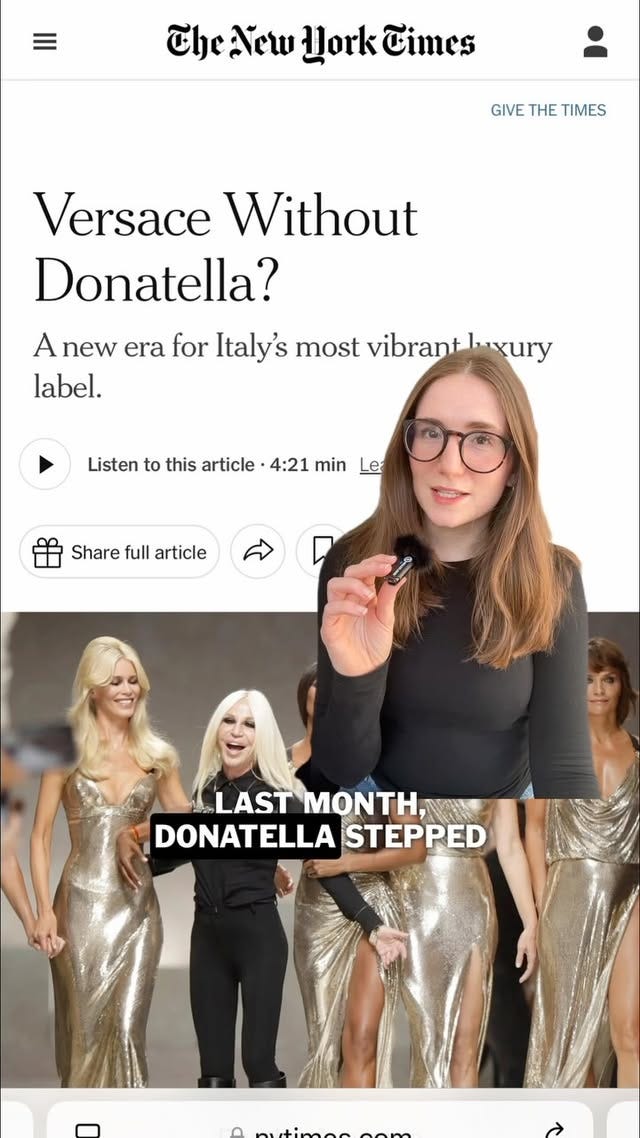

Prada acquires Versace - sans Donatella

Yesterday, Prada Group announced it would be acquiring Versace for nearly $1.4b USD. The goal? To create an Italian luxury contender to LVMH or Kering. The deal has been in talks for some time now, but it’s an interesting time to go all-in: markets are unstable and Versace has been operating at a loss for some time now.

But my biggest question? How the brand will fare under new management, and without its namesake: Donatella Versace. The creative director stepped down last month after 25 years, giving way to Dario Vitale (prev. Miu Miu) who will be carrying the torch forward into the 7th circle (had to, sorry).

When life gives you Lumons…

Apple has been feeling off for some time now. I talked about it in an earlier video: how its Apple Intelligence ads feels decidedly un-Apple. I also walked by a iPhone billboard near Oxford Street the other day, and the entire value prop was around…price? So weird.

But Apple still does have a trick up its sleeve: and it involves substantial investment in Apple TV+ and shows like Severance. In fact, Apple plans to lose between $15-$20b on the business within its first decade. The aim is to increase product stickiness and (I believe) rebuild some cultural relevance. More on that in the video:

A family-friendly comeback?

Last week, I told you that Hooters was going bankrupt - and its new owners were planning to turn it into a family-friendly destination. I then made a video about it, and could have never predicted how passionate people are about the brand.

The general consensus? It would take a lot to shift people’s perceptions. But then that begs the question: why not just purchase the assets and build out a restaurant concept that would actually resonate in 2025?

📈 Intel Files

A roundup of stories caught my attention this week

📉 Everything’s cooked. But you already knew that. This isn’t brand news per say, and I’m no economic policy expert, but Trump’s tariffs are going to have serious, multiplying impact on every major brand on the world. Jaguar Land Rover has suspended exports to the US - even though it relies on the country for 25% of its revenue. Plus, we’re seeing companies choose their language carefully as ‘made in America’ claims now need to hold up. This story is far from done. (BBC)

💪🏻 Young people are really into wellness, like really. The Bank of America found that Gen Z households spend 2.8x more than baby boomers on fitness. And that, despite a drop in discretionary spending because of the um, recession (?!), the category seems to be on the upswing. It’s a good time to run a wellness or non-acoholic beverage brand. (Business Insider)

💉 Ozempic has shrunk Weight Watchers… down to bankruptcy. Counting your ‘bread points’ is a much harder sell when you could just take a shot instead. Although I’m not one to promote diet culture - this does feel sad, in a way. The company has been around since 1963, and while its protocols are slightly problematic, they feel less dystopian than an over-reliance on GLP-1s. (Forbes)

🪷 The White Lotus brand lore continues. Coffee Mate partnered with White Lotus to launch a piña colada a few months ago - but they couldn’t have predicted the season 3 ending. Probably, because the producers filmed SIX alternative show endings in case of leaks. But instead of uncomfortable pushback about brand alignment and reputational risk (ahm Duke), their response was self-aware, funny, and kind of perfect…(WSJ)

🩰 The Royal Ballet and Opera rebranded, and although I don’t really comment on visuals - I have to say I’m obsessed. Designstudio honoured the legacy crest pumped up their signature red, and introduced a playful wordmark that evokes just the right amount of movement. The result is a lovely balance of regal and modern, and has definitely primed me for a matinée of Swan Lake. (Brand New)

🩵 Quick hits

The Generalist is starting a podcast, which is very exciting. The publication, which does the most comprehensive (and well-written) deep dives of corporate strategy online, launched its first episode with Reid Hoffman. The concept? ‘To distribute the future more evenly through conversations with the people who see it first’. I’ll be listening.

Retail brands of the early-aughts are leaning into ‘newstalgia’: a blend of Y2K vibes with modern appeal. I love how Gen Z are obsessed with Y2K fashion - and this piece by BoF covers how brands are riding the wave.

More creator stuff. This article by AdAge talks about how creators are reinventing the beverage market. We’re talking the likes of Alex Coopers’ Unwell Hydration and Kylie Jenner’s Sprinter vodka soda.

Onwards

Last Friday, I told you my next experiment would be to double down on the tink tonk. I did.

Since then, I’ve posted 7 videos, amassed 167K views and gained 50 new followers. Unfortunately that turned into zero Substack subscribers, which was my big fear.

But this hasn’t put me off TikTok. Instead, the experience made me realize 2 things:

My hooks still aren’t great. I’m getting better, but I have a new appreciation for just how much they affect video performance. Conversion starts with top of funnel capture, which I still haven’t nailed.

But most importantly, I’ve realized my content is way too broad. I share smart takes on the brand implications of business headlines… but don’t give people a reason to stick around. No actionable tips, no specific expertise in a single area. This will be an issue for converting viewers into followers, but even moreso for capturing subscribers (owned audience is always the end goal).

Therefore, the next step will be to keep at it, but niche down slightly. Going beyond broad insights into ‘packagable’ learnings. And as you may have guessed by the intro, that next exploration will be in the creator economy space.

xoxo,

The Brandsider